Those who are living on the island for quite some time know: at the turn of the year, there will be some „famous” taxes changes in the Balearic Islands. Starting the year, the islands also have a new government and consequently many things will change that are especially interesting for buyers and sellers of properties.

In our interview, Mr. Arne Seeger from the law office Dr. Früheck Abogados S.L.P. explains the most important changes that concern you as a resident or a non-resident, especially if you own a property or want to sell it.

Contents

- Mr. Seeger, please tell us what will change for taxpayers as from 2016?

- But is that everything?

- In which tax field there will be especially conspicuous changes?

- Not to forget the new EU decision regarding the inheritance law.

- What would you recommend buyers and sellers of properties?

- Will there be changes in building regulations?

- A few words about you: Since last year you are the office manager of the law firm Dr. Frühbeck in the Balearic Island?

- Contact Details Frühbeck Abogados, S.L.P

Mr. Seeger, please tell us what will change for taxpayers as from 2016?

First of all, there is a change in the income tax, the so-called IRPF (Impuesto sobre la Renta de Personas Físicas). We have to distinguish between residents and non-residents. For residents who have to declare their capital gains from real estate such as rental income, this tax increases. Here, the income is crucial because the increase only applies to a tax bracket from 70,000 € of taxable income. For this, a progressive chart is introduced.

For non-residents, this tax will be called I.R.N.R. (Impuesto sobre la Renta de los no residentes) and compared to the I.R.P.F. it will be reduced from 19,5 % to 19 % as from 1st January 2016. This is important and beneficial for those who own a property and want to sell it or rent it out and hence achieve a capital gain or rental income.

But is that everything?

No, there are also changes regarding the wealth tax. Originally, this tax has been introduced for one year only, but annually it is being extended by one year. Therefore it also applies in 2016. Regarding the wealth tax, there are differences between the Autonomous Regions and the overall Spanish regulation. Up to now, the overall Spanish regulation imposed a wealth tax of 0.2 to 2.5 % with a tax-exempt amount of 700,000 €, which until now has been handled the same way in the Balearic Islands.

From 2016, the wealth tax for residents in the Balearic Islands will increase and will be at 0,28 to 3,45 %, meanwhile the overall Spanish regulation will still apply to non-residents.

There are also news regarding the real estate transfer tax: until now properties with a value of up to 400.000 € were subject to a tax of 8 %, with a value from 400.000 € to 600.000 € were taxed at 9 % and a value of more than 600.000 € about 10 %. As from 1st January, there will be a new fourth category that taxes properties starting at 1 million € with 11 %.

In which tax field there will be especially conspicuous changes?

There will be almost drastic changes with the inheritance tax, which is considerably higher in Spain than in Germany. In extreme cases, overall Spain this tax literally was 70 %, whereas every Autonomous Region determined the rate themselves. In the Balearic Islands, the tax of an inheritance between immediate relatives for residents was very low, at 1%.

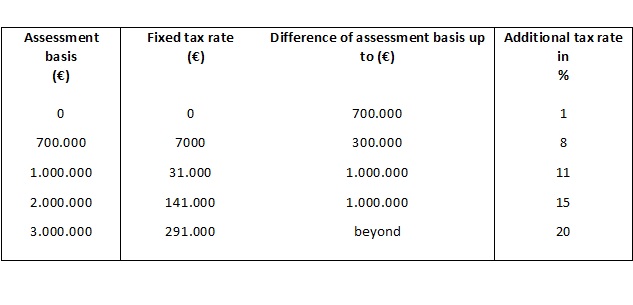

The European Court of Justice has now determined an equal treatment of residents and non-residents, which is especially important to foreign owners of properties in the Balearic Islands. For the year 2016, there will be a progressive tax chart for the Balearic Islands based upon the amount of the inheritance (see the chart below). The gift tax of 7 % will however remain the same.

Tax rates inheritance tax Mallorca as from 2016

As from 2016, the inheritance tax rates in Mallorca will change.

Not to forget the new EU decision regarding the inheritance law.

Without a doubt, the European Inheritance Regulation that came into force on 17th August 2015 is of far-reaching practical significance. Since that date, the inheritance law applicable depends on the residence of the deceased. However, there is a possibility of a choice of law of the country whose nationality he holds. Mallorca residents should therefore consider whether their testament takes into account the new legal situation or there is urgent need for changes.

What would you recommend buyers and sellers of properties?

A good lawyer is currently more important than ever, also because, as experts agree upon, Mallorca has overcome the crisis. The real estate market is booming again, especially in the upper but also in the lower price range. No doubt, now is a good time to invest. Not without reason, the Balearic prices experience the highest growth all over Spain and the development of the real estate market is very positive.

Will there be changes in building regulations?

No, until now, no major changes have been planned in regards to building regulations.

A few words about you: Since last year you are the office manager of the law firm Dr. Frühbeck in the Balearic Island?

Yes, I am from Lübeck and have been working in Spain and Germany as a licensed attorney for real estate and commercial and corporate law since 11,5 years. The law firm Dr. Frühbeck Abogados S.L.P. is the oldest German-speaking partnership in Spain. The office in Madrid was founded in the 50’s and has been successful for 18 years with a branch office in the Balearic Islands.

In our Palma office, there are also tax advisers. Therefore, the client receives, especially when purchasing or selling a property, a final counselling in all legal and tax issues.

Mr. Seeger, we thank you for the interview!

Contact Details Frühbeck Abogados, S.L.P

Arne Seeger

Lawyer & Abogado

Dr. Frühbeck Abogados, S.L.P

C/ dels Caputxins, 4 – Edif. B – 3ºC

07002 Palma de Mallorca

Telf. (+34) 971 71 92 28

Email: arne.seeger@fruhbeck.com

www.fruhbeck.com