There is no doubt about it: Mallorca is more in demand than ever, especially for a second home. Above all, an island property is a worthwhile investment that continues to increase in value every year with unabatedly good forecasts. The question is, what is the best way to finance my property in Mallorca?

Contents

Real estate financing: what options do you have?

If you are buying a property in Mallorca, you have various and interesting options for financing as a non-resident.

Even if you can raise the money for a property purchase directly, it is advisable to consider financing for several reasons: Tax deductions, liquidity protection, and diversification of your investments. It is possible to finance your property in Mallorca through a bank in Spain or private banks in other countries.

One option is to finance real estate in Mallorca through a German bank or building society in Germany. The buyer receives “German” conditions, i.e. an annuity loan with a ten-year fixed interest rate. The interest rate for this financing is guaranteed for ten years and remains unchanged.

Many banks and savings banks in Germany are not particularly interested in financing real estate in Mallorca, despite the rising property prices. Valuing real estate is much more challenging in Germany, as there is no knowledge of the real estate market in Mallorca.

With financing through a Spanish bank, the interest rate is more flexible. Many banks now offer their customer service in German without any problems and provide all-around advice.

The banks most likely to finance a property in Mallorca, even for foreigners, are:

- Abanca

- Banca March

- Bankia

- Bankinter

- BBVA

- Ing Direct

- La Caixa

- Sabadell

- Santander

- Targobank

A property on the Spanish island is a worthwhile investment.

Financing through a bank in Spain

A certain amount of equity is generally necessary, as foreigners are allowed to finance a maximum of 70% of their property, while Spanish taxpayers are allowed a maximum of 80%.

The minimum down payment is usually between 30 and 40 % of the purchase price. In addition, there are the costs associated with the purchase (taxes, notary, registration, and administration costs), which are generally between 10 and 14 % of the purchase price.

Of course, the amount of the loan and the repayment period are decisive. Normally, loans are granted in such a way that the sum is paid off after 15 or at the most 20 years. The base interest rate also depends on whether you are a Mallorca resident or non-resident.

The essentials of credits in Spain

In today’s world, it is no longer advisable to put all your capital into a single investment. Smart financing allows you to preserve your liquidity and diversify into areas with potentially higher returns.

The most striking difference between Spain and Germany in terms of interest rates is not primarily like the interest rates themselves, but rather in the financial products available and the approaches of the respective banks. In both Spain and Germany, both fixed and variable interest rates are offered, and these are linked to the EURIBOR.

This is set by the European Money Market Institute, through which credit institutions lend money to each other, also known as the ¨price of money¨. The monthly average of the 12-month Euribor is the most commonly used benchmark for mortgage rates in Spain.

In Spain, you can get financing with a fixed, variable, or mixed interest rate. With a fixed interest rate, you know what you will pay each month for a certain period or the entire duration of the financing. With a variable interest rate, the interest rate is more competitive but can vary up or down as it is linked to Euribor.

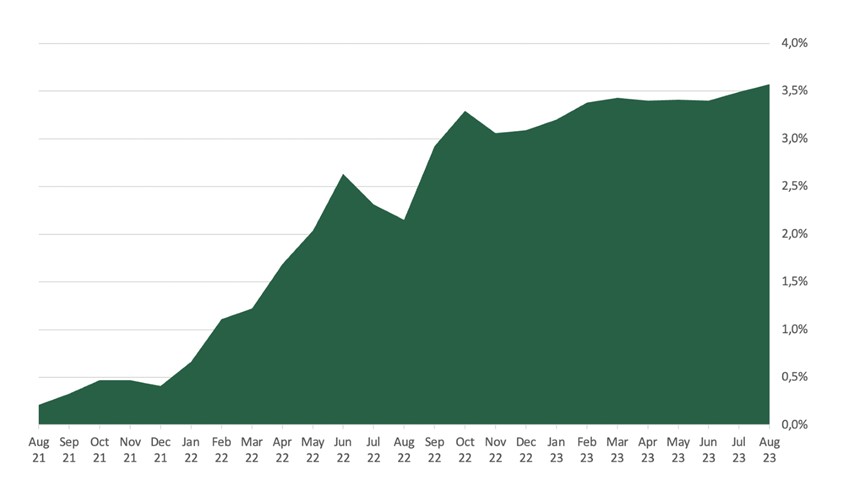

Development of long-term interest rate Spain

Another reason to take out financing is the small penalty for early repayment in Spain. If you want to make an early repayment, you have to pay an early repayment fee. Since 2019, this fee has been regulated by the Spanish mortgage law, which sets limits depending on the interest rate of the loan and how early the repayment is made. The law states that if the interest rate is variable, the maximum early repayment fee is 0.25% for the first 3 years or 0.15% for the first 5 years and 0% thereafter. For a fixed interest rate, the maximum penalty is 2% for the first 10 years and 1.50% thereafter. These penalties are the maximum penalties that the bank can levy and the penalty is only levied if the bank incurs a loss at the time of early repayment.

Before making a decision, it is important to compare and get advice from experienced experts. Financing in Spain is very different from financing in other countries and it is important to know all the options to make the best decision.

How do I take out financing in Spain?

No matter which bank is approached, the documents and the repayment of the loan are checked in detail – such as where the equity capital comes from and from which source the repayment is financed. It now takes at least one to two weeks before the customer receives notification of whether or not the financing will be approved. If the loan is approved, the bank is required to take out a homeowner’s insurance policy and a life insurance policy, if not already in place.

Of course, an account must now be set up at the bank. For this – and in general for the purchase of a property in Mallorca – the very first thing to do is to apply for a Spanish tax number, the N.I.E., at the immigration office, without which no bank account can be set up in Spain, no purchase contracts can be concluded and no taxes can be paid. The N.I.E. is just as important as the assistance of a notary or lawyer, because only with a notarised purchase contract is it possible to register the new owner in the land register. The application for N.I.E. takes some time, which is why you should deal with the issue in good time.

You will need these documents if you are financing with the Spanish bank:

- Copy of identity card or passport with Spanish tax identification number (N.I.E).

- Bank statements for the last three to six months

- Three current payslips

- The previous income tax return

- Statement of assets and liabilities according to the last income tax assessment notice

- Real estate information

If you have already found the right property but have not yet received a financing commitment, an option contract is usually concluded. The purchase of the property and the signing of the financing contract usually take place in the presence of the lawyer or notary on the same day.

The good thing these days is that many law firms and most banks in Mallorca now have multilingual staff. After all, last year around 30 percent of properties in Mallorca – that means almost every third house – were sold to foreigners, with Germans still representing the largest group of buyers.

Once you have realised the advantages of financing your property purchase in Mallorca, it is advisable to contact a specialised financing intermediary, so you save time and do not have to negotiate with each bank individually. At Porta Mallorquina, we work with one of the leading financing experts in the Balearics, Lionsgate Capital, among others, who ensure that all clients always receive the best conditions and financing.

A financing intermediary is an agent who acts as a single point of contact for all banks, saving you time, effort, and money. After an initial discussion to determine your circumstances, current needs, and expectations, you will receive all the information you need about your financing options, including repayments, interest rates, etc.

Getting financing in Spain on your own can be a lengthy process, especially if you are comparing several banks and waiting for their response. Every bank is different and conditions change all the time. Therefore, a professional financial advisor can find the perfect offer for each client, depending on their circumstances and preferences. It usually takes between 8 – 10 weeks from the first meeting to the closing at the notary.

Get competent advice

The chances are good and interest rates in Spain are still lower than in other countries, so why wait? However, with all this, you should be well advised, even more so when buying a house. At Porta Mallorquina, we not only have a versatile selection for your dream property, but together with our network of legal and financing experts, we are of course available to advise and support you.

We look forward to your visit!

Calculate your mortgage now

Before you buy a property in Mallorca, you can get an idea in advance of the savings, fees, and taxes required to buy your dream home.

With the financing calculator from Lionsgate Capital, you have everything at a glance. Test it yourself.