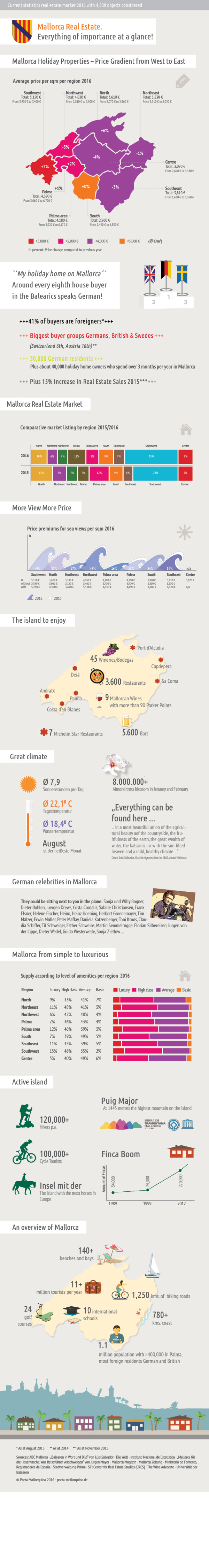

+++Newsticker+++: according to the Spanish office of statistics (INE) 10.605 properties were sold in the Balearic islands in 2015, an increase of 14.6%.

Contents

Representative Market Research

For the second time scientists of the Steinbeis Institute Center for Real Estate Studies, commissioned by real estate agent Porta Mallorquina Real Estate, investigated the vacation property market in Mallorca.

Mallorca holiday properties are becoming ever more popular as an investment. In its market study the Center for Real Estate Studies examined around 4,800 Properties and in 2016 presented an independent price comparison.

What are the current price engines for vacation property in Mallorca? Are there particular location characteristics which affect the price of the property, or at least a great sea view? In addition, many buyers will ask themselves how secure their sales possibilities will be in the future.

To help analyse the underlying structural components the following study from the STI Center for Real Estate Studies in comparison with the market study 2015, throws light on the subject. A total of around 4,800 Property offers were analysed in terms of location, price and amenities.

Key findings from the Mallorca Market Study 2016

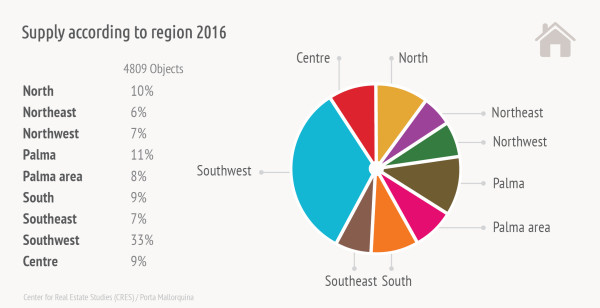

In Mallorca at the beginning of 2016 about 4,800 properties of different categories were for sale. As the following graphic shows, the number of properties are distributed in completely different ways and not in accordance with the regional area size. Thus, more than half of the offers focus on the three top regions “south-west”, “Palma” and “north” with 33%, 13% and 10% respectively. The south-west stands out particularly as about a third of all properties offered are to be found in this relatively small region. Compare this to the south-east region: although one of the largest areas of the island only 7% of the offers are in the south-east, barely more than a twentieth, which puts it in the penultimate position.

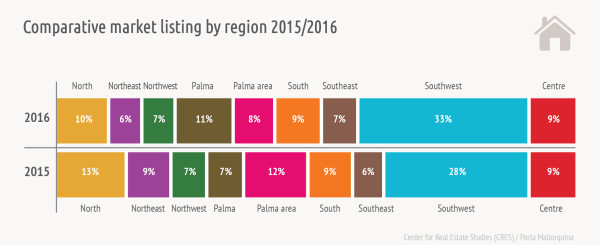

Compared to last year a clear trend toward the west coast, including Palma, is becoming apparent. In both these regions the properties on offer increased by 5% and 4% respectively, whilst in the northern regions the offers decreased, and in the south and north-west stagnated.

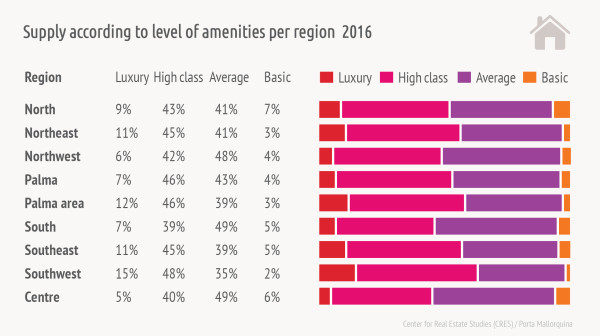

Market Offers according to Equipment Features

Due to its high level of tourism Mallorca is particularly dominated by properties in the upper and luxury sectors. 12% of all properties offered are in the luxury segment and the upper sector makes up, with a 41% share, more than a third of the total market. Less than a twentieth of the offers is taken up by properties of a lower equipment level.

Offer structure according to equipment features. Luxury and upper segment properties dominate the market 2016.

A particularly high proportion of luxury real estate can be found in the south-west of the island. In this relatively small area around 15% of the properties belong to the luxury segment. An above-average proportion of objects of lower and middle quality are to be found in the south and the centre of the island and make up over half of the properties offered, giving investors cheaper opportunities to enter the market.

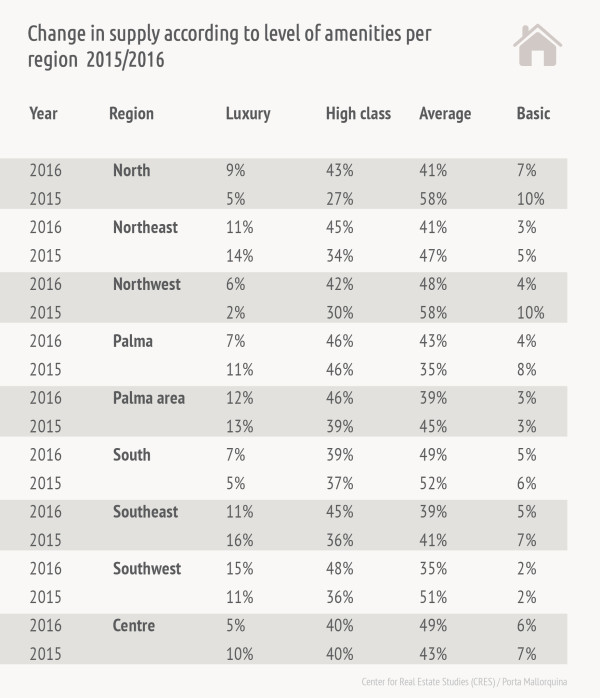

In 2015 almost half of the offers were characterised by a middle standard of equipment and amenities. This proportion reduced during the year by 5% and during the same period the share of objects of a simpler equipment category fell by a further 2%. Thus, the offers in the top categories increased by 7%.

Significant changes in the market according to equipment standards took place in the west of the island. While the proportion of the objects in the middle and more basic categories in the north-west declined by 10% and 6% respectively, in the south-west the mid-level equipment standard reduced by as much as 16%. The largest reduction in properties of the middle and basic categories, however, took place in the north where the offers reduced by cumulatively 20%. Accordingly, the proportion of objects in both the higher classes went up by the same amount.

Particularly in the western part of the island the proportion of luxury real estate increased disproportionately.

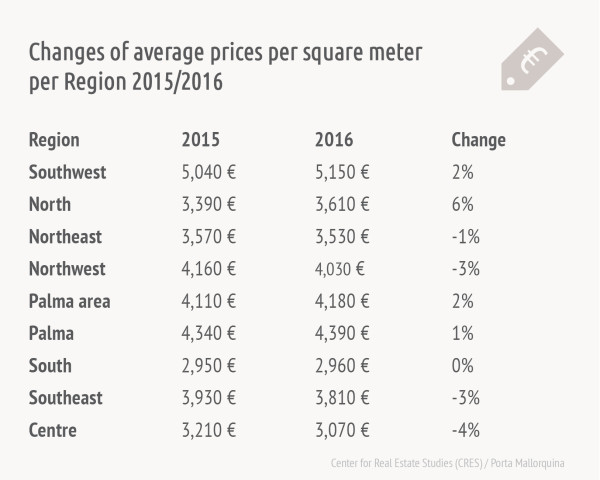

Price Level

The prices are scattered between the different regions, but also significantly within the regions, depending on equipment standard and special amenities.

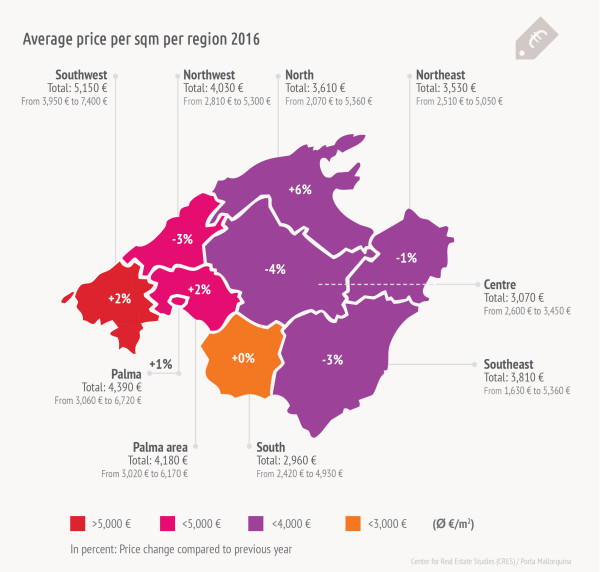

In terms of price per square metre there is a clear regional trend in the west of the island, including the area of Palma and its surrounds. Thus, the real estate in the south-west with an average of €5,150 per square metre is more than two thirds more expensive than in the south, where average prices from €2,960 are to be found. The regions Palma, Palma surrounds and the north-west can be found in a higher price category with average values lie at over €4,000. Here the square metre prices are between €4,030 in the north-west and €4,360 in Palma.

The additional price range for “from´´ (basic accommodation) “to´´ (luxury equipment) shows that, in the top regions, the possibilities for a “bargain´´ exist and that in the more favourably priced areas high values can be achieved for special properties. Consequently, properties offered in the north-west with more basic equipment standards are available for an average square metre purchase price of €2,810.

The prime objects in any area are typically more than twice as expensive as the basic properties. This is particularly evident in the 3 top regions. Entry-level prices there start at €3,020 per square metre in the Palma surrounds and reach up to €7,400 in the south-west. These premiums could make it interesting for higher-level investors, especially as they are also present in other regions. In the comparatively cheaper north part of the island average prices range from the basic to the luxury investment from €2,070 up to €5,360, making a premium of around 160%.

Because of the increase in offers in the course of last year, price development was relatively constant. Many significant price increases, however, were seen in the luxury segment. Purchasers who invested in the luxury segment in the south during the last few years can be satisfied with the fact that, in this segment, prices rose over 10% from 2015 to 2016. But even “bargain hunters´´ realised their investment. While in the top regions of Mallorca prices will rise even further, acquisition of property in the lower segment of the real estate market will become increasingly affordable. Due to the increased prospects of a profitable sale real estate owners are offering older properties from the lower quality segment and are, therefore, opening possibilities for access to smaller investors on the Mallorcan real estate market.

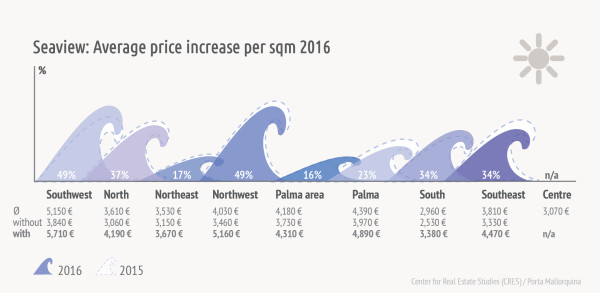

What is the cost of a sea view?

The fact that Mallorca is a holiday region makes sea views a very important quality factor for investors. The aim is to determine how large the price differences are between real estate with and without a sea view, i.e. to what extent are investors willing to pay a premium for properties with a sea view. The following graphic shows, in the two columns, objects presented according to price with and without sea view.

As expected a sea view strongly influences the price of a property. Not infrequently premiums of over 20% are achieved. In Palma an object without sea view costs on average €3,970 per square metre, while for properties with sea view in this region the price averages €4,890. The percentage premiums in the top-region north-west are much greater. As in the south-west investors are willing to pay from €1,700 to 1,870 for an ocean view, corresponding to 49% difference. Thus these two regions are, in terms of sea view mark up, the leaders in the survey, followed by the north with 37% and the south-east with 34%. In the last two places are the north-east and the Palma surroundings with a mere 17% and 16%.

Conclusion

Due to the different regions, equipment and price levels possibilities are present both for the smaller and larger investor, meaning that Mallorca remains very attractive from an investor perspective.

As expected sea views are an indicator of price premiums, and they achieve higher square-metre prices particularly in the popular south-west and Palma areas. It is, however, still possible to find individual objects for favourable low-entry prices. Likewise, there are investors willing to make high investments outside the Palma catchment area. Thus we find a high proportion of real estate in the luxury and high-end in the south-east although the region would normally be in the midfield price segment. The decisive factor here is the relative age of the objects concerned. Properties built within recent years generally have a higher standard of equipment than older objects which tend to be of lower value.

Compared with the previous year regions which already have a high price niveau are showing increases in their average square metre prices – in the top south-west region an increase of more than 2% was registered and the offers in other areas increased. Accordingly, in the future the value stability of the properties will be the focus of investment consideration criterions. It is to be expected that – due to the high demand and the profit motives of the sellers – the prices in the coming year will continue to rise. In addition, real estate prices will orientate themselves on Mallorca´s economic developments which, due to the dominance of tourism on the island, will in turn be dependent on the economic changes in the countries of origin of the investors.

Porta Mallorquina Real Estate executive director Joachim Semrau confirms the increased demand for luxury real estate on Mallorca, and especially the areas around Palma are currently undergoing changes:

“The area surrounding Palma has developed a new face. The large demand for high quality properties in close proximity to Palma no longer relates only to the well-known villa suburbs like Son Vida und Genova, but also increasingly includes the northern and eastern border communities such as, for example, Sa Cabaneta, which belongs to the municipality of Marratxi. ´´

For this reason, new constructions on the hills around the capital have developed in recent years, generally comfortably equipped villas or Fincas with views of the bay of Palma or the Tramuntana mountains.

Infographic Mallorca Properties 2016

Copyright : The infographic is licensed under the Creative Commons license CC-BY- SA . This means that graphics may like to be used and shared . The only condition is the Attribution and a reference to this site as the source .

We appreciate your feedback on the study!