Author: Prof.Dr. Marco Wölfle, Center for Real Estate Studies, CRES

Author: Prof.Dr. Marco Wölfle, Center for Real Estate Studies, CRES

Update 06.2015 Download the Porta Mallorquina “Market Study Majorca Holiday Real Estate Market 2015” (PDF).

Pictures of beautiful landscapes or impressive fincas, luxury villas or modern penthouses in the centre of Palma let investments in holiday properties on Mallorca seem financially attractive. Nevertheless, for investors also considerations about the yield of the property will be most important. Therefore, information about the structure of the market and the stability of value of their investment is important.

Is it worthwhile nowadays to raise the price because of a special location or a great sea view? How certain are your chances to sell and how large will the supply of other sellers be in the future?

CRES – Center for Real Estate Studies

The inquiry of the STI Center for Real Estate Studies commissioned by Porta Mallorquina Real Estate is a first step in the analysis of the structural components that are important on the background. In this study the differences in quantity and price ranges of properties are presented, differentiated according to region and available features.

Contents

Object and Goal

The inquiry analyses the market for real estate properties on Mallorca with the goal to offer a reliable view on the level and structure of the present offer of holiday properties.

Presented is not only the quantitative supply (number of properties for sale), but also the qualitative supply (location, features, sea view), in order to be able to designate them to several price ranges.

Holiday properties on Mallorca – a recent market analysis of the Center for Real Estate Studies offers an impartial view on the market.

We will have to take into account that the pure quantitative supply of properties is easily overestimated when the numbers provided by real estate agents are added up. On the multi-agent-market of Mallorca, it can happen that the same property is for sale with several real estate agents, sometimes even with different specifications.

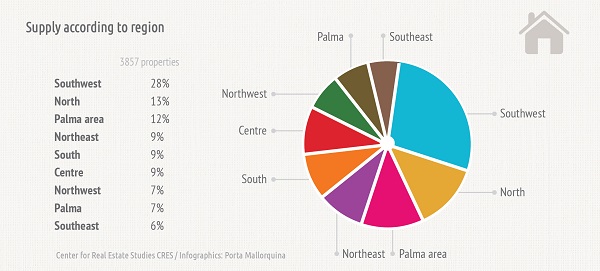

To avoid this kind of distortions the individual property specifications of the market leading agents have been collected and compared, and implausible values or duplicates have been corrected (see attachment for the fundamental data). After correction for statistical outliers, a dataset was obtained of 3.857 properties, the specific features of which we will explore further later on.

Macrosituation and infrastructure on Mallorca

Mallorca is the centre and at the same time the largest island of the Baleares. With approximately 3.600 sq km Mallorca is more than six times the size of the neighbouring island of Ibiza. Thanks to its geographical setting in the western Mediterranean Mallorca, it is easily accessible with flight times of less than 3 hours from Germany. This has also lead to the fact that Mallorca has developed into a medium haul hub for international airlines.

Mallorca is one of the most well loved locations for holiday homes in Europe.

The economy of the island is highly dependent on tourism, especially because of the pleasant Mediterranean climate. Even in winter the average temperatures do not drop below 10° C, while in summer highs of more than 30° C are not uncommon.

Attracted by the agreeable climate and the diverse landscapes, about 10 million tourists visit the island every year. About 23% of them are German, closely followed by the UK with 21%.

From the coastline of appr. 560 km at least 50 km are designated as beaches. These provide even in the busiest season more than enough space for seaside visitors. Mallorca, however, is not only renowned for its beaches and mass tourism. The island also attracts hikers and golf players (24 courts). The restrictive building regulations are profitable for the intrinsic value of existing properties and protect the nature on the island.

Market volumes, location and features

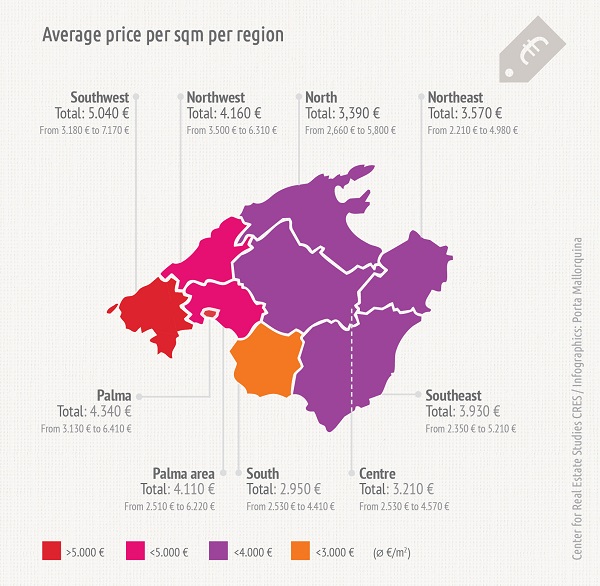

Early 2015 there are about 4000 properties of different categories for sale on Mallorca. The following graph shows that the properties are distributed unevenly over the island and do not correspond to the area size of the region.

More than half of the supply is located in the three top regions “Southwest”, “North”, and “Palma area” with 28%, 13%, and 12%. Especially the Southwest stands out. In that relatively small area, more than a quarter of the supply is located, whereas the larger geographical area of the Southeast is ranked lowest on the list. With only 6% only a very small portion of the real estate supply is located there.

Almost a third of all holiday homes of Mallorca are located in the Southwest of the island.

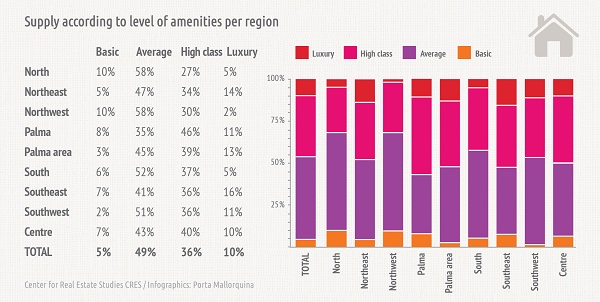

As is to be expected, a high standard of living can be found on the island. 10% of all properties are in the luxury segment and also the high class segment constitutes with 36% more than a third of the total market. Only 5% belongs to the basic property class.

Equipment standards of properties on Mallorca are mostly high class and luxury.

Especially in relation to equipment standards, clear regional trends can be seen. The largest supply in the luxury segment can be found in the Southeast, a region with a relatively small real estate supply (231). An above average part of properties with a basic and average level of equipment can found in the North and Northwest. In these areas, these two segments constitute more than two thirds of the supply and may offer investors attractive ways to enter the market.

Price level

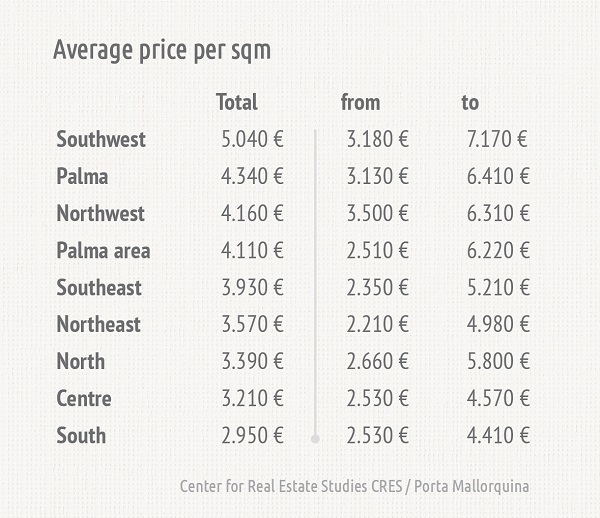

Prices differ between the various regions, but also within each region, depending on the equipment standards and special features of the property.

The prices differ for each region – the more one moves to the west, the higher the prices per sqm.

The average price per sqm is in the Southwest with about €5.040 much higher than in the south, where the average price is €2.950. Besides the Southwest, also Palma and Palma area, as well as the Northeast belong to the top regions. The average prices here are between €4.110 and €4.340.

The price range per region is highly dependent on the equipment quality.

The indicated price range “from” (basic quality level) “to” (luxury quality level) shows that even in the top regions it is possible to obtain a bargain, but also that in the more expensive regions it is still possible to achieve a high price for a special property.

If you settle for a basic level of amenities in the Southwest, an average buying price of €3.180 per sqm would suffice. In the Northwest, however, this would cost almost €320 more per sqm.

The top-quality properties in a region typically cost more than twice as much. This is especially clearly visible in the 4 top regions. Here entry-level prices range from €2.510 per sqm in the Palma area to €7.170 per sqm in the Southwest.

For investors these significantly higher prices for top-quality investments can be very interesting. Even more so because this can also be encountered in other regions. In the relatively affordable North the average prices range from the basic level to the luxury segment from €2.660 to €5.800, which means a markup from around 120%.

How much is a sea view?

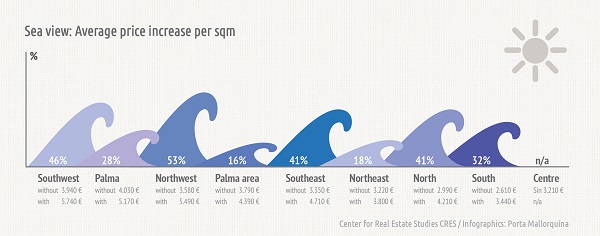

A special feature – especially relevant when looking to invest in a holiday property – is the sea view. How much are investors willing to pay nowadays for sea view? The following graph shows the average prices with or without sea view.

The average price increase for sea view is 23% across the island.

It shows that sea view leads to price increases of more than 20%. For example, in Palma properties without sea view cost on average €4.030 per sqm, while investors are willing to pay an average of €5.170 for properties with sea view. The premium is even bigger in the top region Northwest, but also in the more affordable region North. In both regions the price per sqm increases with more than €1.200.

When we compare average prices with and without sea view, we see premiums in the Northwest of up to 53%, while in the Palma area or in the Northeast prices increase no more than 16% or 18%.

Investor’s perspectives – price according to property categories

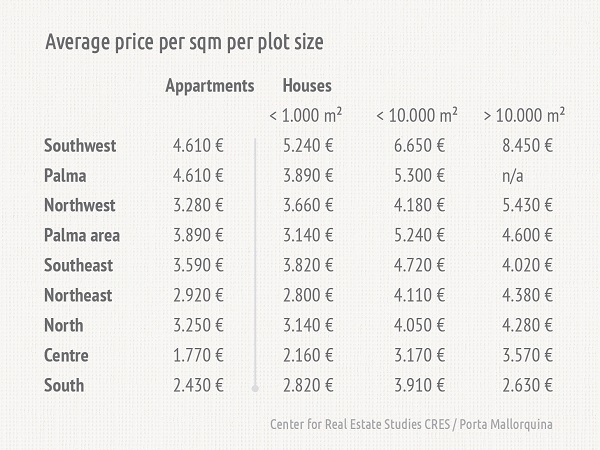

From an investor’s perspective, it is also interesting to analyse the different property categories because currently there are clear market trends visible. Basically, built-up plot space should be more expensive than undeveloped area, if only because of increased material expenses.

The following graph shows that this effect is most clearly visible in the last two colums, where properties with a plot between 1.001 and 10.000 sqm are compared to properties with a larger plot size. The average prices per sqm for larger plots are always less than those for smaller plots.

In general, prices per sqm decrease with increasing plot sizes – except in much sought after locations, such as in the Southwest.

Why is this effect not visible on prime locations or in the comparison of apartments and properties with plots of less than 1000 sqm? The market for properties on prime locations is less liquid. This means there is a lower supply. Special effects and fancy prices can have a strong effect on the average price. Moreover, proportional and in comparison to other categories these categories contain more properties in the high class and luxury segment.

Terraced houses are never situated on large plots, while especially terraced houses and apartments show the effects of a distribution of costs by the use of communal infrastructure and in addition from the perspective of users don’t offer the same feeling of freedom as a detached property. These two effects explain the decreases of the average prices in both categories. They also explain the trend in this graph, which shows reading from left to right, first increasing, then decreasing average prices in every region.

Especially on prime locations in the Southwest investors are willing to pay prices for representative objects which are even for these locations higher than usual. Especially seafront locations and properties located in popular towns and villages are trendsetting for the pricing of these properties.

For top locations, 3 towns stand out: Port d’Andratx, Portals Nous and Son Vida.

Conclusión

Mallorca stays attractive for investors. On closer examination, it becomes clear that different regions, levels of equipment, and different price levels offer a range of opportunities for both smaller and larger investments.

Not very surprising are the high prices and premiums for sea view in the most well known regions, such as Palma and the entire Southwest. On closer examination, however, even here affordable entry-level properties can be found, or are high price investments possible in other regions. For example, prices in the Northeast can be considered as middle range, although exactly here a high percentage of luxury properties can be found. Very important in this respect is the building age of the properties. Properties that were built fairly recently could be built in a higher quality. Properties in regions with more older houses are typically of lower value.

In the Northeast many luxury projects are currently being built, such as eight top-end fincas on Carrossa near Artà.

Most important for investment considerations will be the question of stability of value. This is on the one hand very much dependent on the specific property, but will on the other hand follow the general trend of the economy. The economy of Mallorca is dominated by the tourism industry and will therefore follow the economic trends of the home countries (Germany and the UK) and depends on the local legal frameworks.

![]() You can download all charts, figures and the full study free of charge here: Market study holiday properties in Mallorca

You can download all charts, figures and the full study free of charge here: Market study holiday properties in Mallorca

Copyright graphs and pictures: Porta Mallorquine Real Estate S.L.